After half a year Gracy Chen, Bitget CEO, gave her second interview

Six months have passed since the first interview with Gracy Chen. In the second half of the year, Bitcoin (BTC) achieved a historic milestone by reaching a price of $100,000. Over the past six months, Bitget has solidified its position among the leading centralized cryptocurrency exchanges, the United States elected a crypto-friendly president, and several cryptocurrencies – including Bitget’s native token, BGB – reached all-time highs.

We once again asked Gracy Chen for her perspective on the current state of the cryptocurrency market, her thoughts on the causes of growth, which narratives she plans to focus on in the coming months, and where she sees Bitcoin’s price peak.

We had our last interview about half a year ago. Since then, the entire market has experienced significant changes. From your perspective, what have been the most notable improvements in the crypto market? Do you believe these improvements are driven more by macroeconomic stabilization or by fundamental innovations?

The crypto market has seen remarkable developments, with Bitcoin regaining its upward momentum and institutional adoption gaining traction. Macroeconomic stabilization, including easing inflation and supportive fiscal policies in certain regions, has created a conducive environment for growth. Simultaneously, technological innovations like blockchain scalability, real-world asset tokenization, and advancements in decentralized finance (DeFi) have enriched the ecosystem. The rise of AI integration into trading and analytics has further amplified market efficiency. These dual forces of economic factors and innovation are driving the industry towards a more mature and sustainable phase, appealing to both retail and institutional participants.

As the CEO of Bitget, how do you assess your company’s position in the CEX market compared to the beginning of the year? How has Bitget adapted to and benefited from the growing global interest in cryptocurrencies?

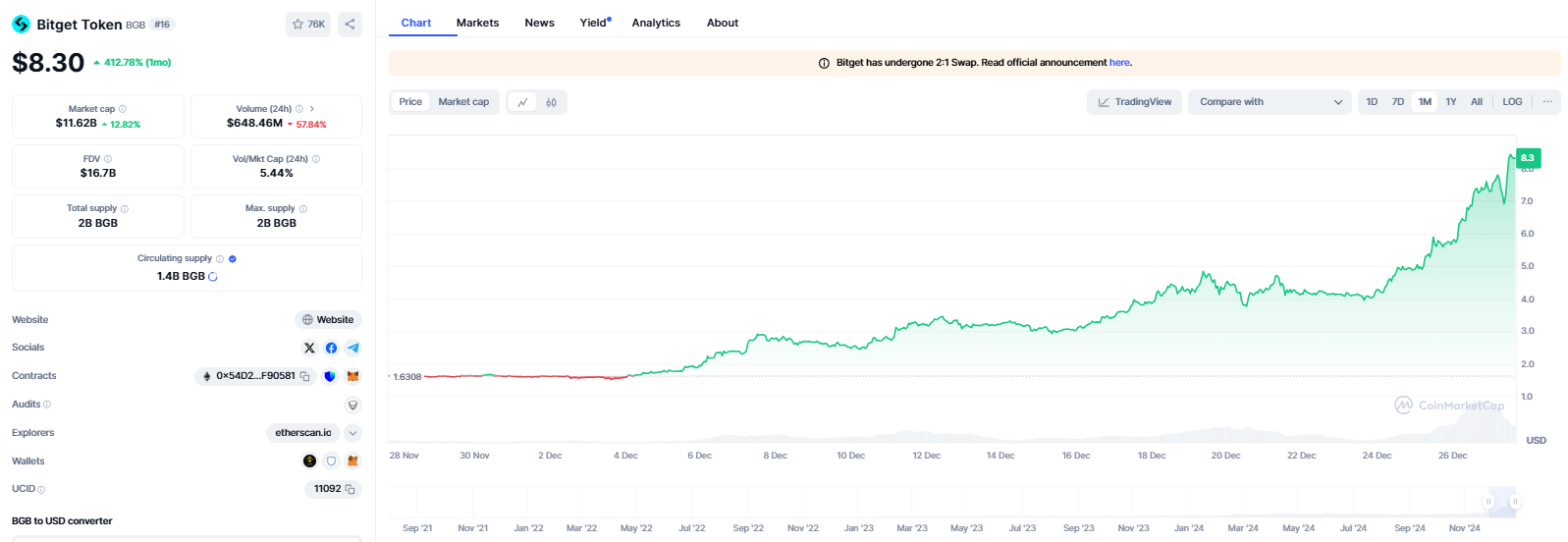

Bitget has grown tremendously as a leading cryptocurrency exchange, with our innovative features like copy trading continuing to gain traction among users globally. Over the past six months, the performance of the BGB token, which saw over 500% growth, has shown the growing confidence in our ecosystem. We’ve also focused on improving user experience and enhancing security, which are paramount in today’s environment. Our expansion into regions like Southeast Asia and Latin America and increased engagement with institutional clients have solidified our position as a trusted and dynamic player in the CEX market.

What plans does Bitget have to further increase its market share over the next few years? Are there any specific partnerships or strategic innovations that you believe will support the growth of trading volume and user adoption on a global scale? Which markets do you see as key areas for expansion in the coming years?

Our roadmap includes global expansion into emerging markets, such as Southeast Asia, Latin America, and parts of Africa, South Asia where interest in crypto is rising rapidly. We are also working on strengthening our presence in developed markets through enhanced institutional offerings. Strategic partnerships with blockchain projects, sports entities, and financial institutions will play a critical role in increasing visibility and user engagement. Furthermore, we are investing in educational initiatives, such as the Bitget Builders Program, to empower new users and developers. These efforts, combined with continuous innovation in product offerings, are aimed at increasing trading volumes and global adoption.

Given the current macroeconomic landscape, how do you view the regulatory environment for cryptocurrencies? Do you believe that institutional adoption is encouraging regulators to be more open and supportive, or do you see it as a factor that could present new challenges for the industry? There have been discussions about the impact of recent political developments on the cryptocurrency market. In your view, how might global political changes shape the future of the crypto industry? Are there any specific events or appointments you believe could have a notable impact, such as changes in regulatory leadership or policy shifts?

The regulatory landscape remains a mix of opportunities and challenges. On one hand, institutional adoption has pushed regulators to introduce clearer frameworks, such as crypto licensing and ETF approvals, which enhance market credibility. On the other, concerns around security, taxation, and anti-money laundering persist. The increasing collaboration between regulators and industry players is promising, but achieving a balance that supports innovation without stifling growth is critical. At Bitget, we actively engage with regulators worldwide to align our operations with emerging standards and support an ecosystem that adheres to compliance while supporting user growth.

Political changes, such as new leadership or shifts in regulatory priorities, can profoundly affect the crypto market. For example, discussions about cryptocurrency-friendly policies under certain administrations could accelerate adoption, while stricter stances may temporarily hinder growth. Recent geopolitical events, like the re-election of leaders with supportive crypto policies, have bolstered market optimism. Similarly, regulatory appointments in influential economies could drive critical changes, such as the introduction of central bank digital currencies (CBDCs) or Bitcoin reserves. The global crypto market is deeply intertwined with political dynamics, and staying updated with these changes is essential for navigating its future.

Artificial intelligence is a prominent topic in discussions about technological advancement. How do you see the potential relationship between AI and the blockchain industry? Could this relationship play a role in shaping a brighter future for cryptocurrencies?

The integration of AI and blockchain is one of the most exciting developments shaping the industry’s future. AI can enhance blockchain applications by optimizing trading algorithms, ensuring data integrity, and personalizing user experiences. Blockchain, in turn, provides AI systems with secure and transparent data frameworks. This synergy has the potential to revolutionize areas like decentralized finance, NFT gaming, and identity management. As AI agents become more important in trading and user interactions, concerns about market manipulation and ethical practices will need to be addressed. The convergence of these technologies could lead to the growing advancements in the crypto space.

Bitget’s BGB token has been one of the standout performers of the year, with an almost 500% YTD increase. What do you think are the key factors that have contributed to BGB’s strong performance? How do you see the future of BGB, and do you believe it has the potential to join the top 20 cryptocurrencies by market capitalization?

BGB’s surge to an all-time high of $4.45 in December, marking over 120% growth in the month, highlights the strength of Bitget’s ecosystem. Key contributors include the success of BGB Launchpool, delivering high APR returns, and the introduction of LaunchX, which saw $400M USDT in participation and a 7252% oversubscription rate. These initiatives, combined with a 266% year-on-year increase in monthly visits and Bitget ranking third in global app downloads, showcase strong investor confidence. As Bitget continues to innovate and expand globally, BGB is well-positioned to sustain its upward trajectory and compete among top exchange tokens.

Of course, this is not financial advice, but are there any narratives or specific projects that you find particularly exciting or promising? The NFT market has seen relatively low activity in recent years, but last month’s increase in volume has raised some interest. Do you believe trends like the AI boom or developments in gaming could play a role in shaping the future direction of the market?

The convergence of AI and blockchain is an area of significant interest. AI is not only making trading more efficient but also opening up new opportunities in predictive analytics and personalized financial services. Similarly, blockchain gaming is evolving into a robust ecosystem where players can own and trade assets seamlessly. Real-world asset tokenization is another trend that could redefine investment opportunities by bridging traditional finance and blockchain. These narratives, combined with the resurgence of interest in sectors like NFTs and MEME tokens, indicate a dynamic future for crypto, where innovation continues to attract both users and investors.

Investors are always curious about the market’s potential for growth, and we’ve seen numerous predictions. As one of the most prominent leaders in the industry, where do you see the market heading in the next 6 to 12 months? Do you believe in the idea of a four-year cycle driving cryptocurrency market movements?

Bitcoin’s long-term trajectory remains bullish, supported by factors such as increased adoption, regulatory acceptance, and technological advancements. By 2025, Bitcoin could potentially reach $200,000, driven by ETF approvals, institutional investments, and geopolitical shifts favoring crypto. Over the longer term, as market maturity increases and scalability solutions improve, Bitcoin’s volatility is expected to decline, aligning itself for some steady growth.

For the second time, Gracy Chen has shared key insights about Bitget’s operations and the anticipated trends in the cryptocurrency market. With its wide range of products and services, Bitget and the BGB token aim to solidify their leading position in the CEX market, providing strong competition to Binance.